Mitigating tax credits - CROSSING OF TAX INFORMATION

February 12, 2019 at 10:59 am,

No comments

What taxpayers should be aware of is the integrity of the information provided by various accessory obligations, that is, the information must be consistent with one another so that a more detailed tax review process is not opened.

Conferences are relatively simple if we look at the following:

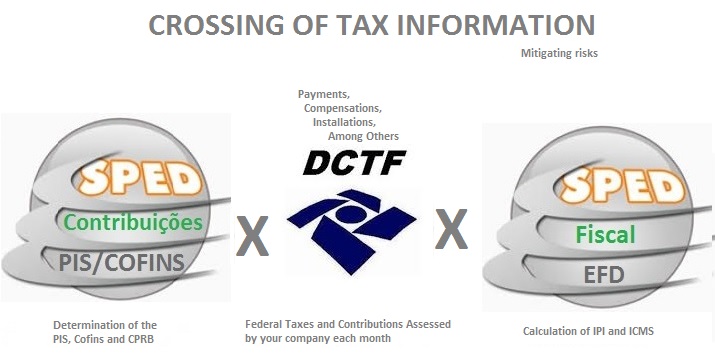

- In SPED FISCAL (EFD), your company declares information regarding the calculation of ICMS and IPI.

- In SPED CONTRIBUTIONS (EFD-C), your company is obliged to declare the information related to the PIS, COFINS and CPRB.

- To finish, your company delivers the DCTF that will contain all information regarding the Federal Taxes and Contributions Determined every month, that is, again information on those mentioned above. Other information of great importance in the DCTF are the information related to the existing installments and compensations, as well as payments made, among other things

In a very simple analysis, if the taxpayer stated in SPED FISCAL (EFD) that he owed R $ 10,000.00 PIS, he should have also declared in DCTF how the payment was made, that is, he made a payment in the amount of R $ 10,000 , 00, or a smaller amount but with compensation of existing credits or still made a installment.

These divergences between values are enough for FISCO to be able to raise a warning light and notify the company and / or to open a fiscalization process, which is extremely stressful for the company.

With the use of our tool, RADARFISCORP, you can proactively avoid sending contradictory information to the tax authorities, avoiding a series of problems with the supervisory bodies.