Mitigating tax credits - CROSSING OF TAX INFORMATION

How Digital Tax Transformation Can Shake Your Business

Henniges Automotive inaugurates factory in Jundiaí - São Paulo - Brazil

Henniges Automotive, a North American multinational that operates in the automotive sector, inaugurated its plant in Jundiaí on Thursday (31).

Henniges Automotive, a North American multinational that operates in the automotive sector, inaugurated its plant in Jundiaí on Thursday (31).The forecast is to create 300 direct jobs within three years. The investment is US $ 30 million, approximately R $ 120 million.

The executive director, Ronaldo Lemos, explained to the Tribuna de Jundiaí that the plant will attend General Motors (GM), with the production of rubber seal system for a new global project of the automaker, which will be launched in the second half of 2019 .

"For this, Henniges will have the workforce of 300 employees and high-tech equipment," he said.

The factory has 11 thousand square meters. The raw material used in the production of rubbers is also produced in Brazil, with a promise of not being added to the environment, in addition to filters installed in the plant to avoid odors.

Henniges produces rubbers to seal the trunk, vehicle body, door channels, windshield wiper grill and those located above the headlight, specifically for GM Brazil.

SOURCE : Newspaper Tribuna de Jundiai - SP - Brasil

https://tribunadejundiai.com.br/noticias/economia/6757-americana-hengine-automotive-inaugura-fabrica-em-jundiai

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

TECNOLOGY SHOULD OPTIMIZE FISCAL AND TAX PROCESSES IN YOUR COMPANY

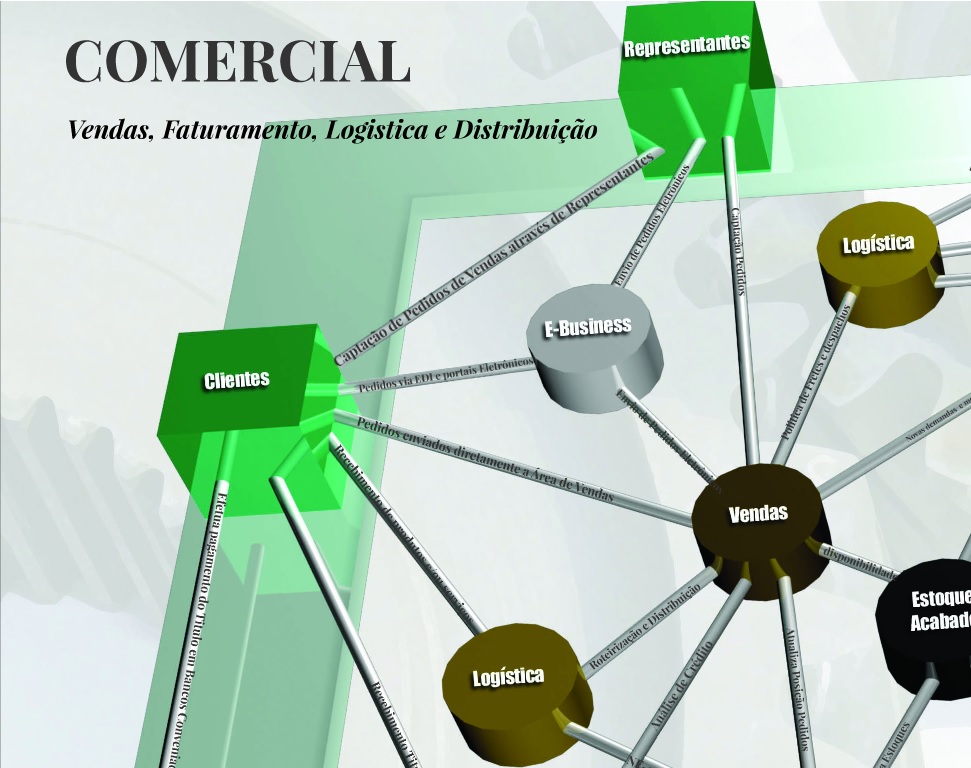

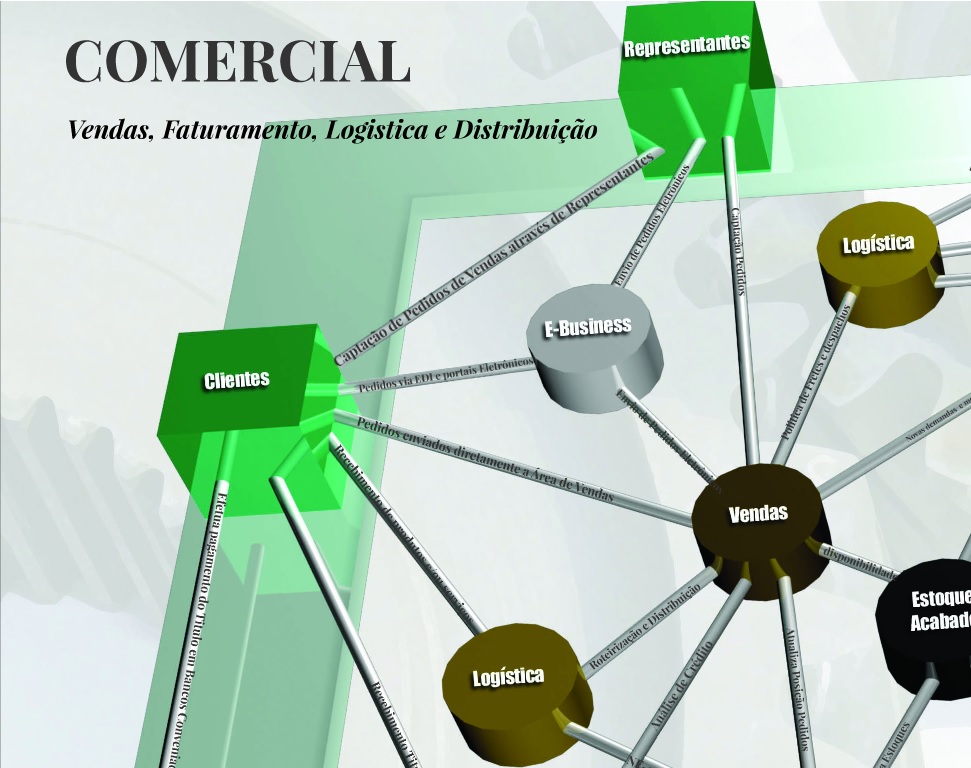

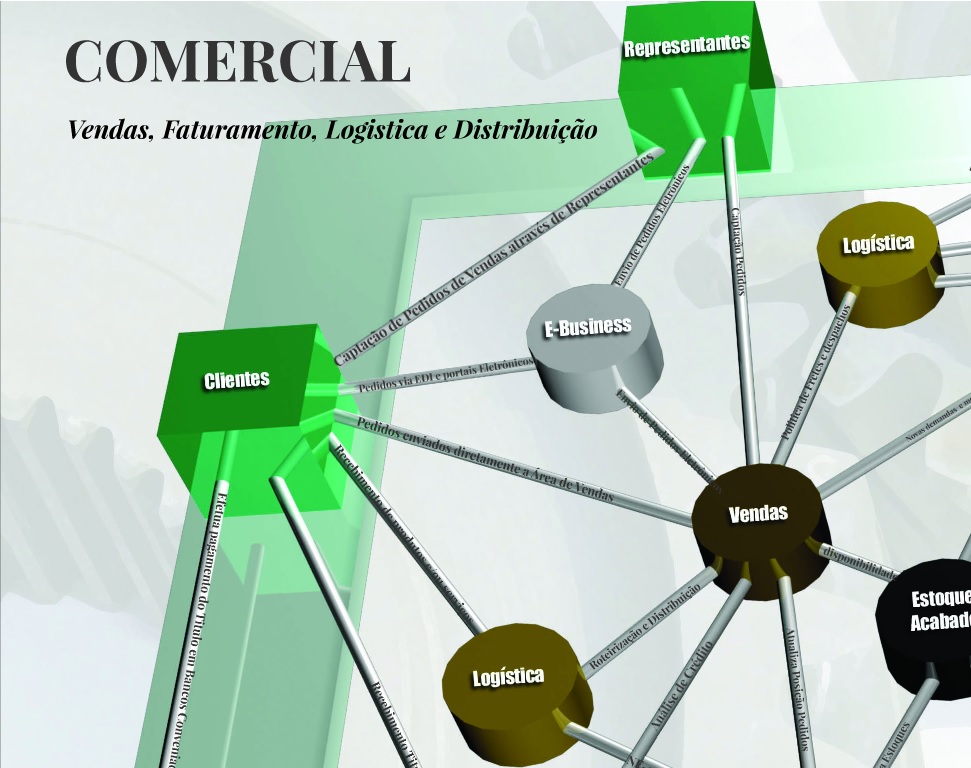

When the information related to the Sales processes is not generated correctly through the Commercial Area, they can generate information on aliquots and tax incidents in an incorrect way, which can lead to unnecessary taxation or undue credits in relation to the definition of aliquots of the most diverse taxes .

In relation to

the operations of Invoices of Invoices referring to acquisitions in the

local market, interstate or in the foreign market, they must have their

taxation done correctly, as they may affect undue tax credits.

When

a purchase is made for consumption and even then the company

parameterizes the system to credit taxes, or worse, when there is no

credit for the taxes to which they are entitled, thus generating a

financial and tax loss for the organization.

Not least, the information on the processes of manufacturing and control of processes on the floor of Fabrica, as well as the management of stocks of Raw Material, Processed Products and Manufactured Products is of fundamental importance so that it can be presented to the tax information thus avoiding unnecessary penalties.

Of course, if we

are talking about an Integrated Information System, and when we say

integrated it is that there is only one and only one system generating

all this information simultaneously, not requiring separate systems for

the generation of information in what we call a transactional system, that is, all transactions are generated based on the same values.

Of

course, for example, the price information of the order sent to the

Supplier must be in accordance with the amount in the invoices received

from said product and the values of the taxes and goods must be correct

so that the system can make the payment or the receipt of the amounts correctly, as well as the collection of any taxes.

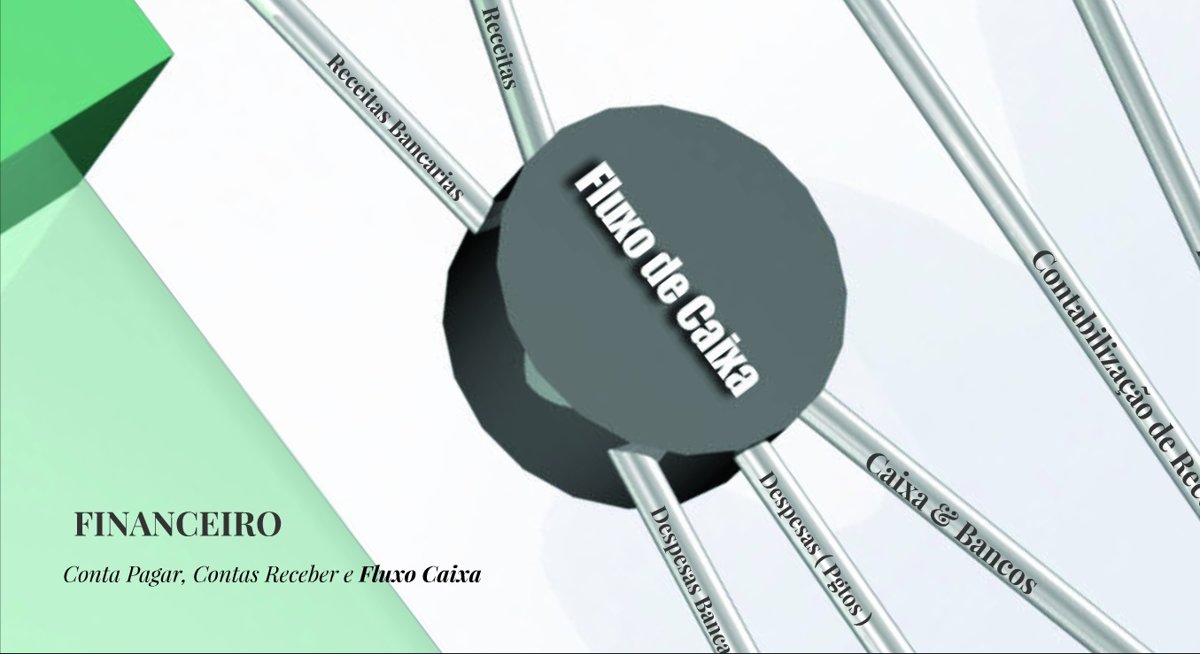

The

Company's Financial Area should not pay or receive amounts that are not

duly substantiated by documents processed in earlier stages, and this

is easily detected in a primary cross-reference of information.

All information

is directed to the Controllership Area, where the transactional

information is synthesized and generating hundreds of information for

the strategic decisions of the Organization.

All information

is directed to the Controllership Area, where the transactional

information is synthesized and generating hundreds of information for

the strategic decisions of the Organization.

Today, across a variety of devices, technologies must be prepared to deliver strategic information often in real time or as defined by their executives.

Overview of ERP PROCESS - Example : our ERP USCORP

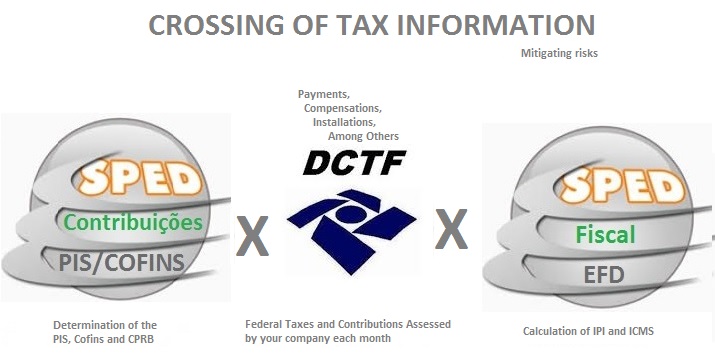

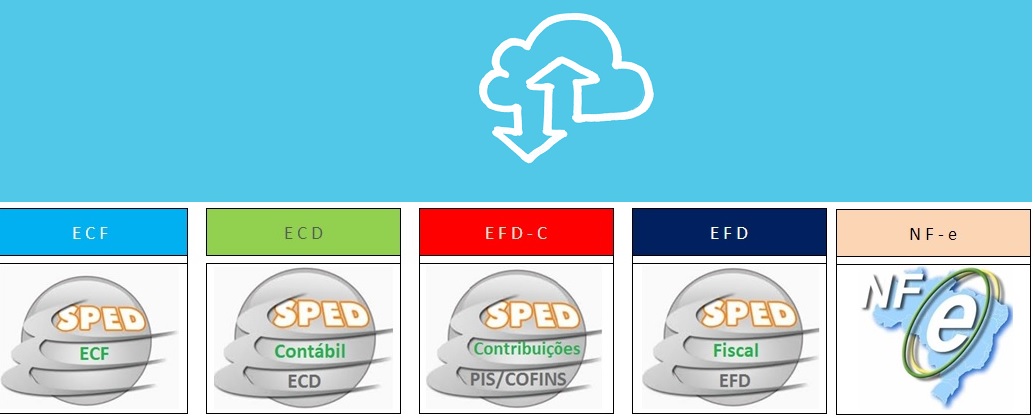

CROSSING OF TAX INFORMATION - The Omission on Tax Deeds

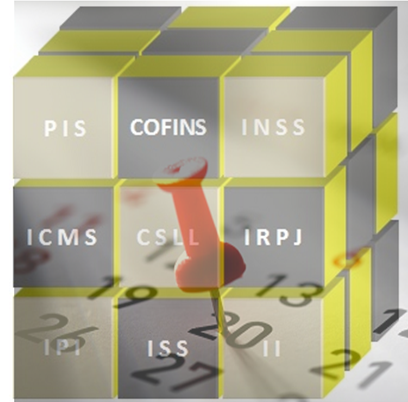

The incorrect omission or calculation of the taxes involved in the above transactions (ICMS, IPI, PIS, COFINS and ISS) may affect the calculation of the Company's Income Tax and that will affect the ancillary Obligation (SPED ECF) to be presented to the end of the fiscal period.

Any omission of bookkeeping or divergences in these deeds are subject to notifications by the Treasury and unnecessary tax assessments before the treasury.

Some of our main taxes Main Stages of Taxes in Organizations

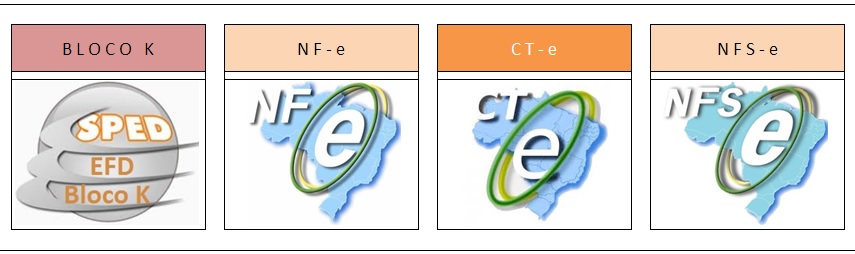

Some of the main accessory obligations

Example of some of the Exit operations processes

Examples of some Transactions involving the Purchases and Receipts Receipts Area

Examples of operations involving the Floor Manufacturing and Stocks

CROSSING FISCAL INFORMATION - The non-accounting of Input and / or Output Operations

Let's say that vendor X sold a product to buyer Y, but this did not write the invoice. The buyer will be asked about this, after all how does he buy a product and not write the note? It is your obligation to show the acquisition of the merchandise in accessory obligations.

Worse still is if vendor X sells and does not write down the note because it is omitting revenue. In addition to failing to contribute to ICMS, PIS and COFINS, it will affect the calculation of your company's Income Tax.

Therefore, all notes issued or received must be written with the same values and data.

Any omission of bookkeeping or divergence in this process may lead to a notice requiring explanations and corrections, in addition to the risk of notice.

Process Examples for Exit Operations

Examples of processes related to the Purchasing and Receiving area of internal Suppliers

Example of operations involving the factory floor and inventories

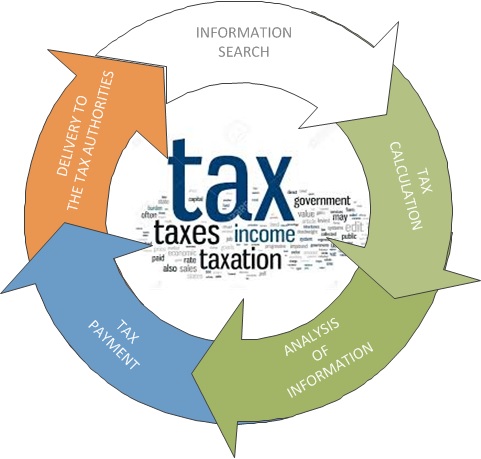

Matrix of intersection of Tax information

CROSSING FISCAL INFORMATION - Negative impact

It will be necessary to implement a project to recover this benefit where a request will be filed with the State or the Federal Revenue according to the methodology defined for each tax.

The Federal Revenue Service or the State has the discretion to inspect this company and if there is any divergence in the information, the requested credit may be glossed or the company be sued for irregularity in its bookkeeping.

Have you ever imagined the impact on your budget?

Therefore, this source of data and information is extremely important.

During the inspection, Federal Revenue or State will cross the different obligations that must be delivered by the taxpayer.

The ancillary obligations, even in different formats and layouts, should present the same values and results.