CROSSING FISCAL INFORMATION - The non-accounting of Input and / or Output Operations

May 4, 2018 at 9:14 am,

2 comments

In these cases, the Internal Revenue Service crosses information between the supplier and the buyer.Let's say that vendor X sold a product to buyer Y, but this did not write the invoice. The buyer will be asked about this, after all how does he buy a product and not write the note? It is your obligation to show the acquisition of the merchandise in accessory obligations.

Worse still is if vendor X sells and does not write down the note because it is omitting revenue. In addition to failing to contribute to ICMS, PIS and COFINS, it will affect the calculation of your company's Income Tax.

Therefore, all notes issued or received must be written with the same values and data.

Any omission of bookkeeping or divergence in this process may lead to a notice requiring explanations and corrections, in addition to the risk of notice.

Process Examples for Exit Operations

Examples of processes related to the Purchasing and Receiving area of internal Suppliers

Example of operations involving the factory floor and inventories

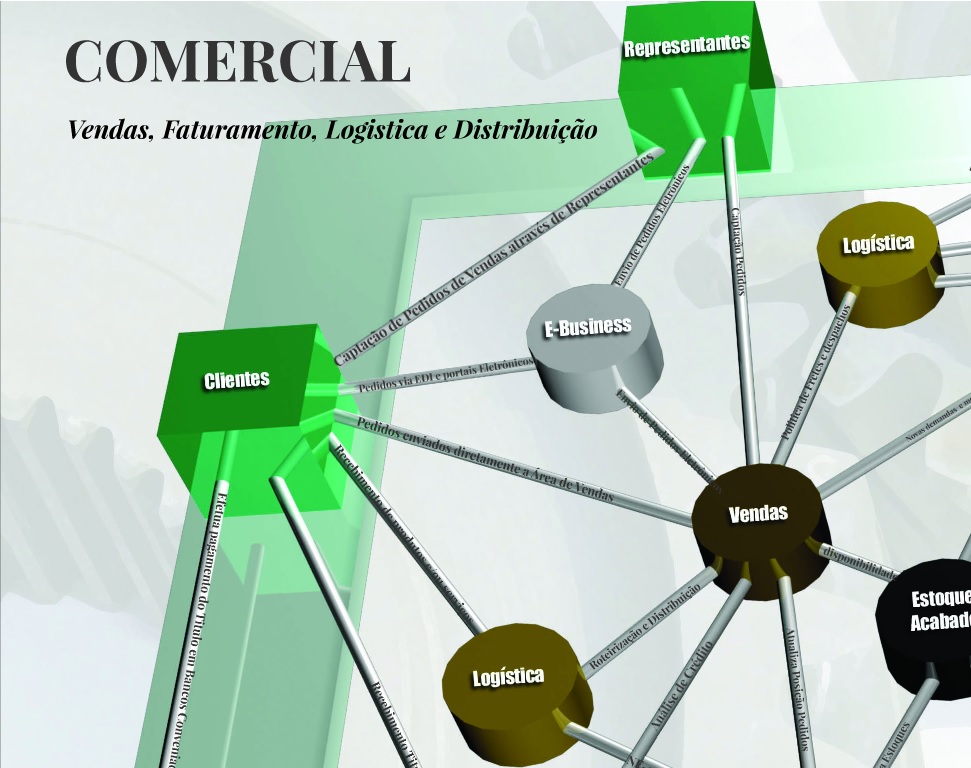

Matrix of intersection of Tax information

2 comments - CROSSING FISCAL INFORMATION - The non-accounting of Input and / or Output Operations

Tarhib IT - December 31, 2023 at 11:41 pm

Input-output analysis: This might be about an economic framework that analyzes the interdependencies between different sectors of an economy based on the flow of goods and services. I appreciate the insights you provided in your blog. Thank you for sharing this valuable information.

Tarhib - May 8, 2024 at 3:08 am

This blog post provides a fascinating exploration of the complexities surrounding fiscal information and the implications of non-accounting for input and output operations. The author's insights shed light on the potential risks and challenges faced by businesses in navigating fiscal compliance. It's evident that staying informed and proactive is crucial in today's regulatory landscape. Kudos to the author for offering such valuable guidance!