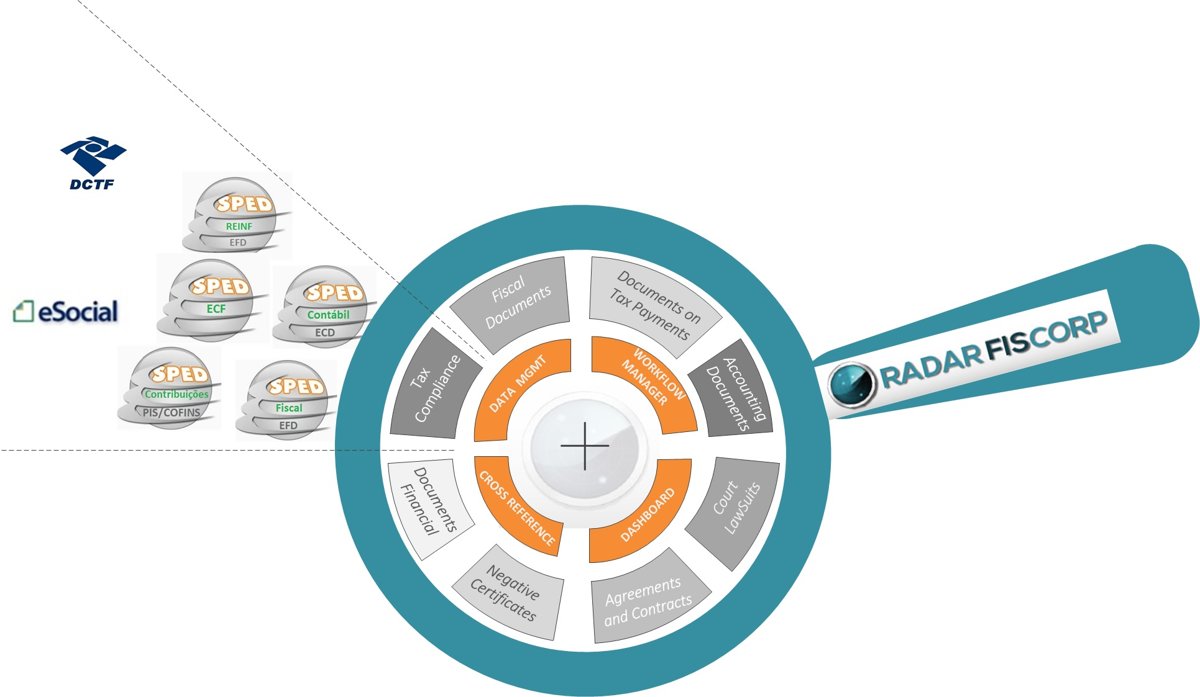

ABOUT RISK FISCORP

MANAGEMENT, MONITORING AND AUTOMATION OF FISCAL ACTIVITIES

DEFINITION OF THE TAX OBLIGATIONS OF THE ESTABLISHMENT (s)

Business Group - Companies - Branches

It is possible to parameterize all Fiscal Activities of the Establishment so that the System can effectively generate alerts and mechanisms of Follow-up of the most diverse activities, and of the most diverse Natures (Accessory Obligations, Payment of Taxes, etc.).

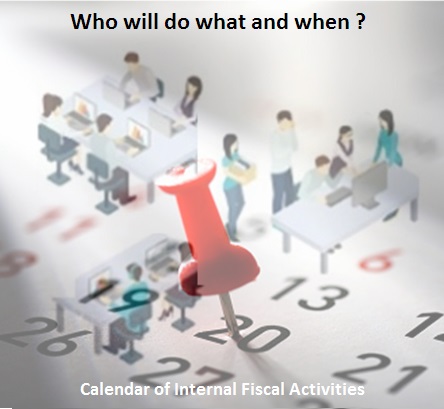

DEFINITION OF PERSONS RESPONSIBLE FOR TAX TASKS AND OTHER PREVIOUSLY ESTABLISHED PROCEEDINGS

For

example, after definition of the Companion Obligations of the

Companies, the Branches and the Business Group, it is possible to define

who is responsible for the delivery of the task, as well as the

responsibilities of the Managers at Management and Management levels

that can be notified electronically when the execution of a certain Event is not completed, completed after the deadline, etc.

FOLLOW-UP - EXAMPLES OF SOME MONITORED ACTIVITIES -

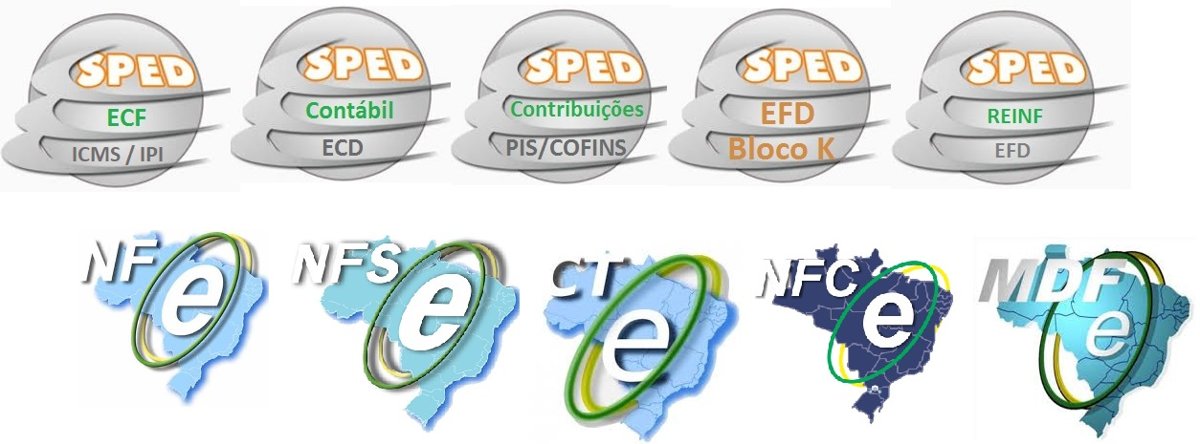

Accessory obligations

Among the main activities to be monitored, one of the most important is the delivery of SPED Electronic documents

UP-LOAD OF FILES - Loading Files of various types

(.XML, TXT, PDF, DEC, REC, ZIP)

All Tax documents are sent to Nuven Storage in a fast and safe way and always at the disposal of the Tax Office.

All files are duly validated and information may be crossed before sending it to the Government.

UP-LOAD OF SPED FILE INFORMATION, TAX NOTES AND TRANSPORTATION

For customers using ERP'S Integrated with FISCORP Fiscal Solution, the Load of this Information is Automatic.

For other users the UP-LOAD mechanism of the files is available

UP-LOAD OF OTHER TAX DOCUMENTS

The system provides the UP-LOAD mechanism of the files in the most diverse standards.

Files (.xml, txt, pdf, dec, rec, zip)

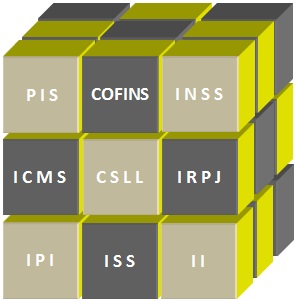

Type of Files (.xml, txt, pdf, dec, rec , zip ) Taxes, Fees and Contributions in the Country

DASHBOARD - UP-LOAD CONTROL PANELS OF FILES

Managers

of the Fiscal Area and Company Management can monitor at any time and

in any place the Status of the Tax Obligations, identify eventual delays

of delivery of Obligations and immediate action with the responsible

and its respective Manager.

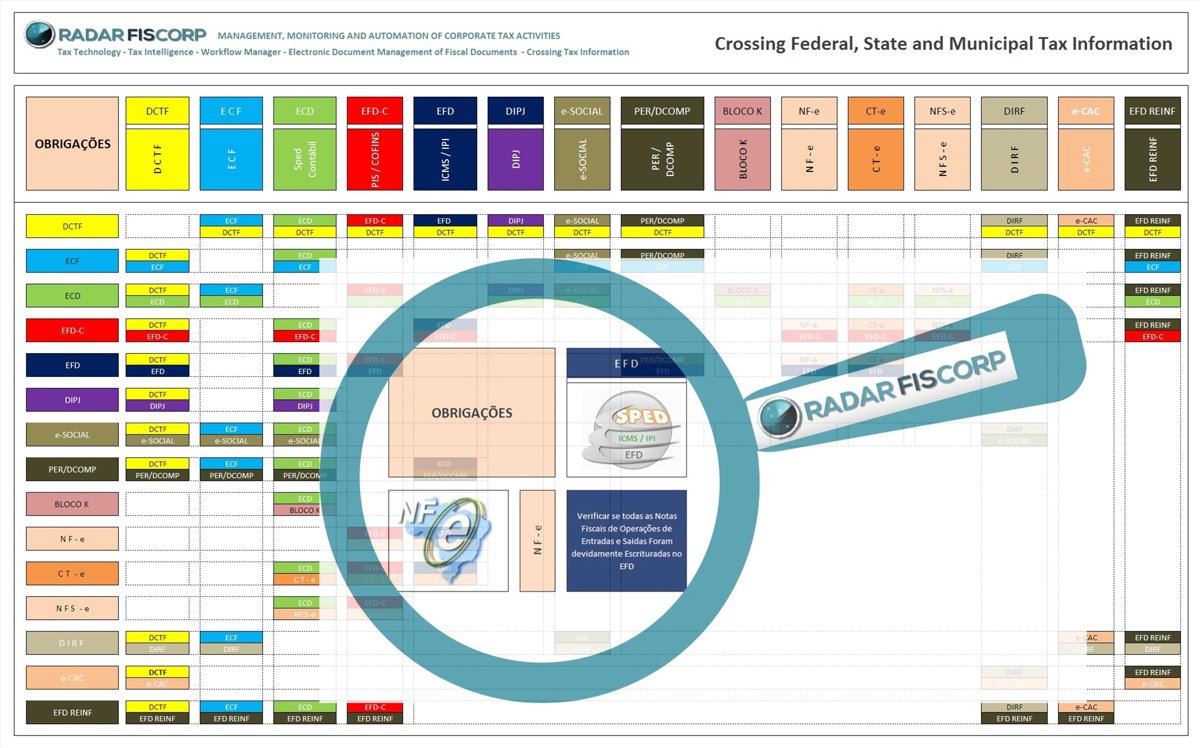

CROSSING OF TAX INFORMATION

The Electronic Crossing of Tax Information is the Tool that can and should act in a preventive way, that is, before sending the information (SPED's for example) to the Treasury, the system enables a quick diagnosis with alerts for possible corrections and Analysis before sending it to the Treasury.

This means greater Management and Mitigation of Tax Risks.