ELETRONIC INVOICE 4.0

The Electronic Invoice (NF-e) 4.0 was started up in July 2018.

ABOUT TAXES IN BRAZIL

IRPJ - Imposto de Renda Jurídica

What is IRPJ ?

This is corporate revenue tax and applies to the net profits of any legal entity in Brazil. IRPJ is a federal tax paid by public or private legal entities residing in Brasil, regardless on their purposes or nationality.

The tax rate is 15% or 25%

How Much the companies Pay ?

In the beginning of every year, tax payers prepare an annual adjustment declaration, related to the previous year´s earnings.

Then the values will pass through the Federal Revenue evaluation, to be approved or rejected. The whole process runs online.

In Brazil, the IRPJ taxations is proressive, which means that the more a company earns, the more it will pay.

This way, the tax´s aliquots are directly proportional to the tax payer´s income and will be calculated over a basis.

The tax calculation basis is 15% on the companie´s earning, plus a surtax of 10% (on annual income over BRL 240,000.00.

CSLL - Contribuição Social sobre o Lucro das Pessoas Jurídicas

Is a social contribution on net income that applies to the net profit.

It is charged over every legal entity resident in the country and those that are treated by tax legislation.

The tax rate is 9%

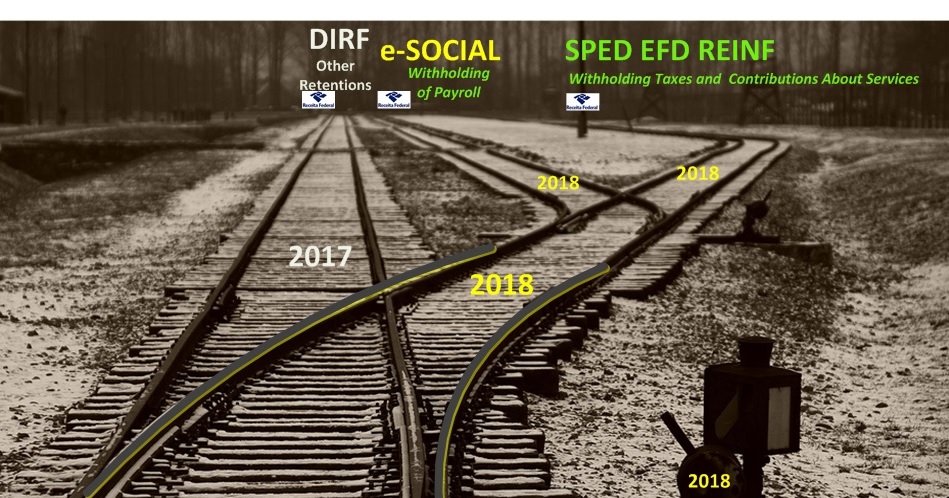

SPED EFD REINF

WHAT IS SPED REINF?

The Digital Tax Bookkeeping of Withholdings and Other Tax Information EFD-Reinf is one of the modules of the Public System of Digital Bookkeeping - SPED, to be used by legal and physical persons, in addition to the Digital Bookkeeping System of Tax, Social Security and Labor Obligations - eSocial.

Its purpose is the recording of income paid and withholdings of Income Tax (Physical persons), Corporate Tax (IRPJ/CSLL in Brazil), Social Contribution of the taxpayer except those related to the work and information on the gross revenue for the calculation of the replaced social security contributions.It will replace, therefore, the module of the EFD-Contributions that determines the Social Security Contribution on Gross Revenue (CPRB).

EFD-Reinf with eSocial, after the beginning of its obligatoriness, opens space for replacement of information requested in other ancillary obligations, such as GFIP, DIRF and also ancillary obligations established by other governing bodies such as RAIS and CAGED . Visão Geral do Projeto da Receita Federal com Abrangência no SPED REINF e no E-SOCIAL

Visão Geral do Projeto da Receita Federal com Abrangência no SPED REINF e no E-SOCIAL

Among the information provided through EFD-Reinf, the following are highlighted:

- Services taken or provided by way of assignment of labor or works;

- Withholding tax (IR, CSLL, COFINS, PIS / PASEP) levied on miscellaneous payments made to individuals and legal entities;

- Resources received by / transferred to a sports association that maintains a professional football team;

- The commercialization of production and the calculation of the social security contribution replaced by agroindustries and other rural legal

entities;

- Companies that are subject to the CPRB (see Law 12.546 / 2011);

- Event promoters that involve a sports association that maintains a professional football club.

WHEN DOES IT COME INTO FORCE?

In January 2018, along with eSocial, for companies with turnover exceeding 78 million.

The list of obligated taxpayers will be published by the RFB.- to entities that promote an event that involves a sports association that maintains a professional football club.

WHAT IS THE SOLUTION OF RADARFISCORP ?

Below is an overview of our integrated solution with USCORP ERP or Third Party ERP:

Overview of SPED ECF REINF Processing and Interaction of Our Fiscal Solutions with ERP'S Third Parties