FEATURES

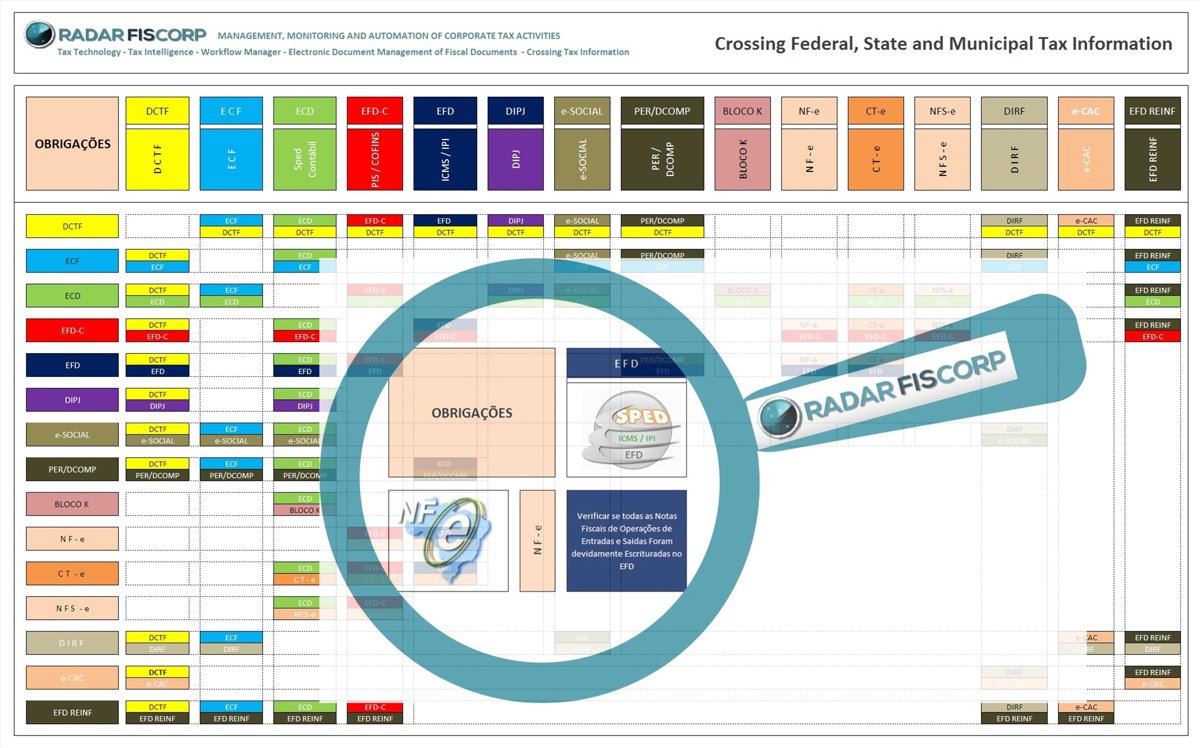

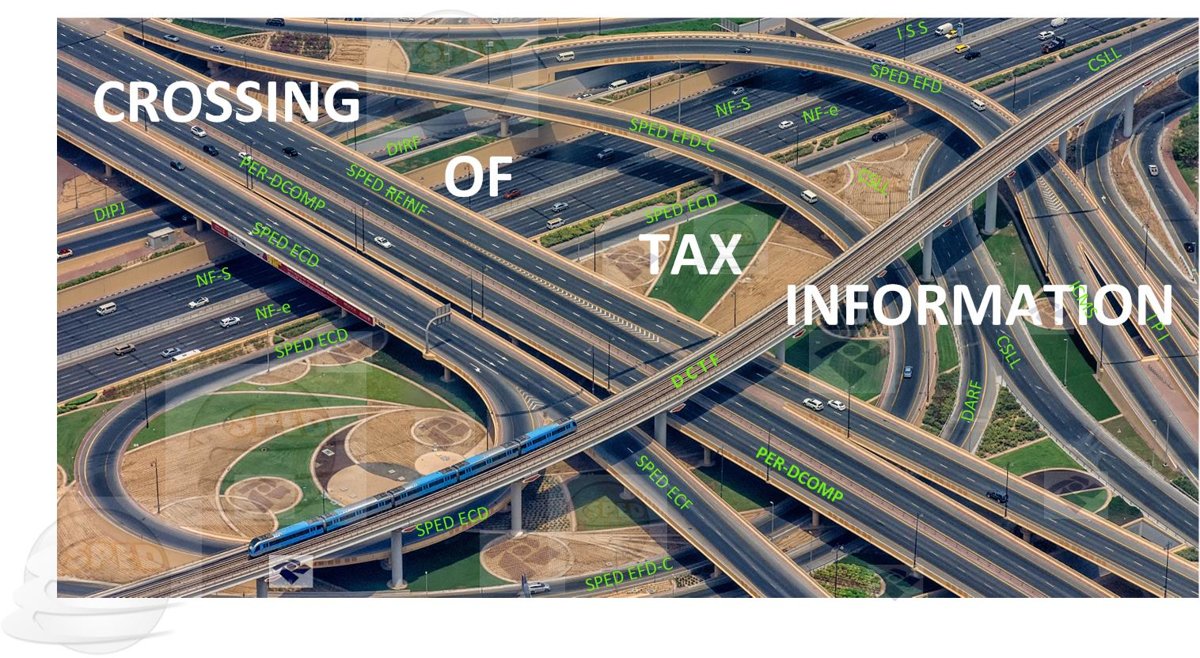

CROSSING OF TAX INFORMATION

The Electronic Crossing of Tax Information is the Tool that can and should act in a preventive way, with it it is possible to anticipate eventual irregularities in the digital files that are necessary to send to the Government.

Thus, it is possible to take preventive action in the preparation stage of the files for sending to the Treasury, thus mitigating Risks of Reports and sending of inconsistent information.

The system enables a quick diagnosis with alerts for any corrections and analysis before sending it to the Government.

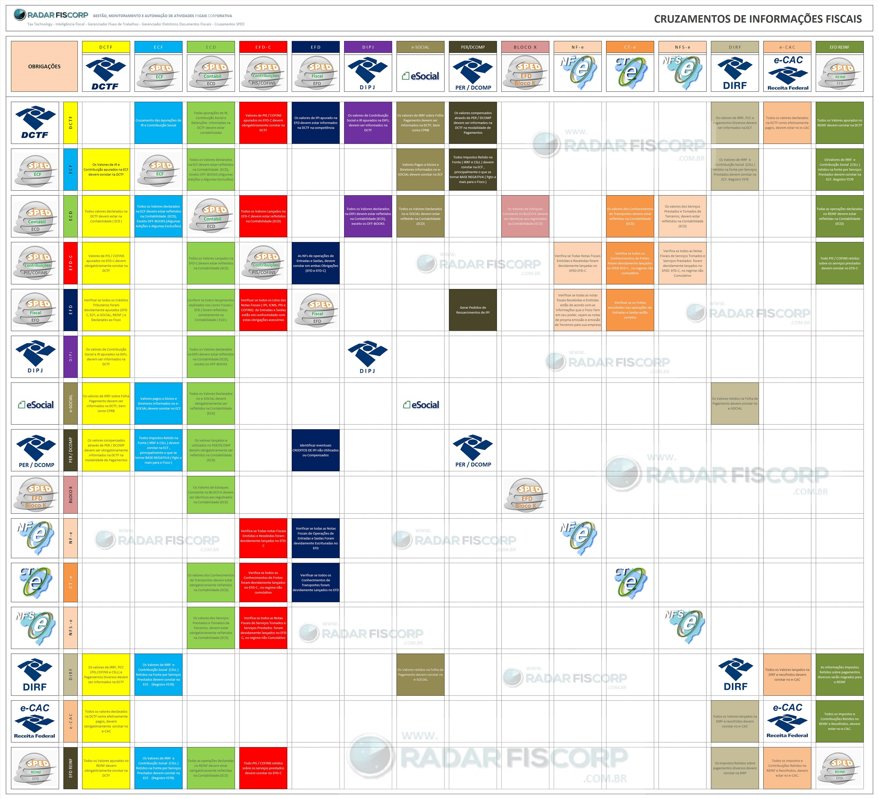

SOME OF THE MAIN CROSSING OF TAX INFORMATION, BASED ON THOUSANDS OF RULES

The

Electronic Crossing of Tax Information is the Tool that can and should

act in a preventive way, that is, before sending the information (SPED's

for example) to the Government, the system enables a quick diagnosis with

alerts for possible corrections and Analysis before sending it to the Federal Government.

This means greater Management and Mitigation of Tax Risks.

ANALYSIS OF PRELIMINARY INFORMATION

Analyze information before sending to the Government, avoiding errors in subsequent steps.

BASE OF DATA IN THE CLOUD FOR GENERATION OF FISCAL AND MANAGEMENT INDICATORS

Tax information is made available for the Generation of Performance Indicators for decision making at all Management Levels